Are You At Risk Of Being Denied Coverage?

Car insurance is meant to protect you financially on the road, but many drivers don’t realize how easy it is to invalidate their coverage. Insurance companies are known for slyly jumping on any opportunity to screw you over, so make sure you're not giving them any chances. A simple misstep can leave you personally liable. Here are 20 mistakes that can jeopardize your car insurance.

1. Being Dishonest

Lying on your insurance application about things like your driving history or parking location to get a lower premium might be tempting, but those companies know more than you think. You could be found out, and your entire policy could be nullified.

2. Failing To Update Your Address

Insurers base risk on where you live. Changing your address with your insurance company can easily slip your mind, but make sure you do it, as moving without notifying them can invalidate coverage.

3. Letting An Unlisted Driver Use Your Car

Letting an unlisted driver use your car may seem harmless, but it can create major problems with your insurance, especially if you do it often. Insurance companies base your premium on the specific drivers listed on your policy, so if someone who isn't listed gets into an accident, they might deny your coverage.

4. Using Your Personal Vehicle For Commercial Purposes

Because individual auto insurance doesn't cover business use, avoid using your personal car for commercial reasons. Insurance companies classify commercial driving as much higher risk, so using your car for business without telling them is considered nondisclosure.

5. Failing To Disclose Modifications

Because insurance companies base your premium on your car's exact specifications, you must disclose modifications. Some mods increase risk, and failing to report them can count as fraud.

6. Driving With an Expired License

Driving with an expired license is the same as driving with no license at all. Even if it expired yesterday, you're no longer legally allowed to drive, and driving with an expired license can lead insurers to say you violated the terms of your policy.

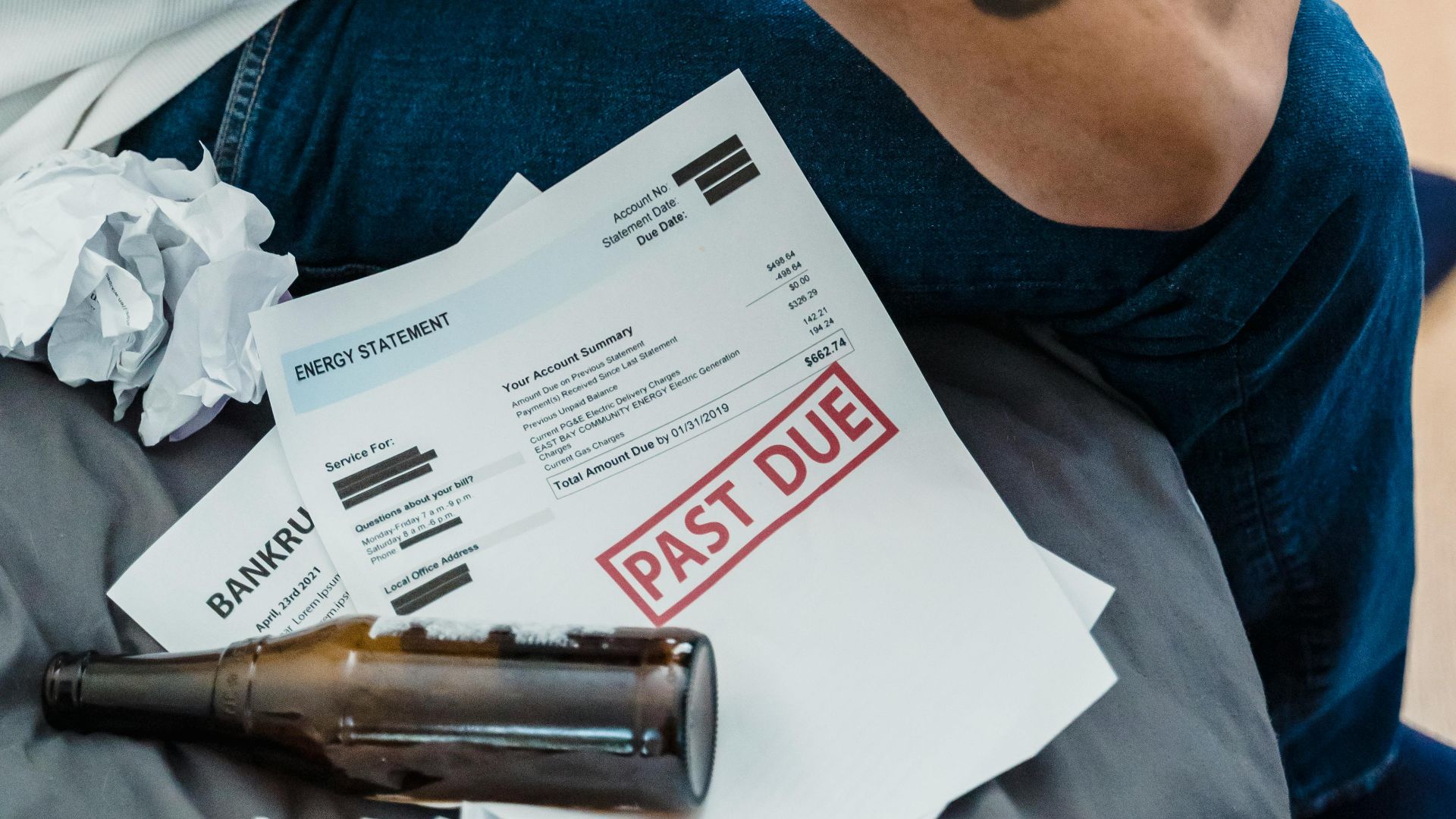

7. Missing Premium Payments

Missing even just one payment can lead your insurance company to terminate your policy. It also raises your future premiums, and you may have to pay late fees.

8. Not Reporting Minor Accidents

Even minor fender benders that seem like nothing at the time should be reported. If you don't report it, it can come back to bite you because it can turn out to be more serious, and your insurer can later argue you violated the terms of your policy.

9. Leaving Your Keys In The Car

Leaving your keys in the car, whether in the ignition, cupholder, or elsewhere, can be considered negligence if your car is stolen. The insurance company may argue that you failed to take reasonable precautions to protect your property.

Frank Leuderalbert on Unsplash

Frank Leuderalbert on Unsplash

10. Not Disclosing Medical Conditions

Not disclosing medical conditions that inhibit your driving ability can seriously jeopardize your coverage. If your insurer later finds out that you withheld a condition that could impact safe driving, they may argue that the policy was obtained under pretenses.

11. Racing Your Car

Insurance policies are intended to cover normal driving. Racing is illegal in most places and is considered a high-risk activity, which is outside the scope of standard coverage, and can lead to your insurer cancelling your policy.

12. "Fronting"

"Fronting" or listing a more responsible driver with a clean record as the main driver to get a cheaper premium is considered fraud. It can lead to the insurer cancelling your policy and may even bring legal consequences.

13. Not Disclosing Driving History

Failing to disclose driving history or lying about your driving history is considered fraud. It can lead to policy cancellation and a higher premium or difficulty getting insurance in the future.

14. Letting Your Car Become Unsafe

Most insurance policies require that your vehicle be in a safe condition. If you fail to do regular maintenance on your car and this leads to an accident, your insurer may refuse your claim, citing negligence.

15. Significantly Underestimating Your Annual Mileage

When applying for insurance, you must provide an estimate of how many miles you drive annually. If you severely underestimate, it can be considered misrepresentation, and you might be denied coverage.

16. Overloading Your Car

Manufacturers assign cars a maximum weight, and insurance policies require that your car be used within these limits. If damages or injuries occur while the vehicle is overloaded, your insurer can deny or reduce the claim.

17. Driving Under The Influence

Driving under the influence of drugs or alcohol is a serious offense that can void your car insurance. It's an illegal action that can result in policy cancellation and significantly higher future premiums.

18. Admitting Fault At The Scene Of An Accident

Even if it really was your fault and it seems like the right thing to do to admit it, it's better to keep your mouth shut. It's up to insurance companies to investigate. If you admit fault, your insurer might limit your coverage.

19. Accumulating Too Many Traffic Violations

Insurance premiums are based on your driving record. If you have too many traffic tickets under your belt, your insurer might deny claims, citing reckless driving or negligence.

20. Allowing an Unlicensed Person to Drive Your Car

You're held responsible for whatever damage your car causes, whether it's you or someone else behind the wheel. Letting someone without a license drive your car is considered negligence, and your insurer can refuse to cover damages.